This represents an increase of 200 basis points from 32 per cent recorded in March 2024, according to an analysis of the Consumer Price Index report released by the National Bureau of Statistics on Wednesday.

The Federal Government had ruled out the importation of food as part of strategies to address the high costs of foodstuffs and the economic hardship troubling the country.

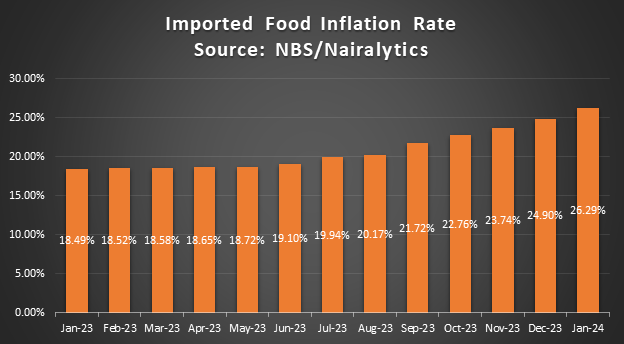

However, internal and external factors including global supply chain shocks following the Covid-19 pandemic and the Russia-Ukraine war, surge in global oil prices, FX scarcity and subsequent depreciation of the local currency have increased the nation’s dependence on food imports.

In April, Nigeria saw its inflation rate rise for the 16th straight month, spurred by a threefold surge in electricity tariffs and increased transportation expenses.

This represents a month-over-month increase of 0.49 per cent points in the headline inflation rate but was lower than the median estimate of eight economists in a Bloomberg survey of 34.2 per cent.

Comparing year-on-year data, the inflation rate in April 2024 was 11.47 percentage points higher than in April 2023, where it stood at 22.22 per cent. This indicates that the headline inflation rate has risen significantly over the past year.

A report by Financial Derivatives, however, stated that the outcome of the national data did not take into consideration petrol scarcity. Next month’s reading will capture the effect.

The acceleration raises the prospect of another interest-rate hike when the central bank’s monetary policy committee meets next week. It’s already lifted borrowing costs to a record high to curb price growth and boost the naira.

Core inflation, which excludes farm produce and energy costs, quickened to 26.8 per cent from 25.9 per cent and food price growth accelerated to 40.5 per cent in April from 40 per cent a month earlier.

Additionally, on a month-to-month basis, the inflation rate for April 2024 was 2.29 per cent, which is 0.73 per cent lower than the 3.02 per cent recorded in March 2024.

This suggests that the rate at which prices increased in April 2024 was slower than the rate in March 2024.

The report read, ”In April 2024, the headline inflation rate increased to 33.69% relative to the March 2024 headline inflation rate which was 33.20 per cent. Looking at the movement, the April 2024 headline inflation rate showed an increase of 0.49% points when compared to the March 2024 headline inflation rate.

On a year-on-year basis, the headline inflation rate was 11.47 per cent points higher compared to the rate recorded in April 2023, which was 22.22 per cent. This shows that the headline inflation rate (year-on-year basis) increased in April 2024 when compared to the same month in the preceding year (i.e., April 2023).

Furthermore, on a month-on-month basis, the headline inflation rate in April 2024 was 2.29 per cent, which was 0.73 per cent lower than the rate recorded in March 2024 (3.02 per cent). This means that in April 2024, the rate of increase in the average price level is less than the rate of increase in the average price level in March 2024.”

Similarly, the food inflation rate reached 40.53 per cent on a year-on-year basis, marking a substantial increase of 15.92 percentage points from the 24.61 per cent recorded in April 2023.

significant rise in food inflation can be attributed to higher prices for several items including millet flour, garri, bread, prepacked wheat flour, and semovita, all of which belong to the Bread and Cereals class, as well as for yam tuber, water yam, and cocoyam and others.

For the year ending in April 2024, the average annual rate of food inflation stood at 32.74 per cent, representing an increase of 9.52 percentage points over the 23.22 per cent average annual rate recorded in April 2023.

“On a month-on-month basis, the food inflation rate in April 2024 was 2.50 per cent which shows a 1.11 per cent decrease compared to the rate recorded in March 2024 (3.62 per cent). The fall in Food inflation on a Month-on-Month basis was caused by a fall in the rate of increase in the average prices.”

Kogi retained its title as the most expensive state, with an all-items inflation rate of 40.84 per cent, against food inflation which stood at 48.62 per cent.

Kwara food inflation upscaled to the second place against the third spot it recorded in the preceding month to a record of 46.73 per cent.

Ondo, Osun and Akwa-Ibom food inflation stood at 45.87, 45.62 and 45.09 per cent respectively. While all-items inflation for the states were 38.12, 37.17 and 36.03 per cent.

However, it was no different in Edo State, as the cost of foods and services was pushed higher as a result of a 44.59 per cent food inflation and 32.72 per cent on all items inflation.

Abia and Rivers’s all-items inflation rates exceeded 35 per cent driven largely by food price hikes against an average of 44.53 per cent on food inflation.

Oyo also experienced a significant jump to 43.53 per cent in food inflation while Ebonyi state joined the list with inflation rates exceeding 39.18 per cent.

The report noted that Lagos state had the highest surge in the price of food and all items inflation by 4.74 and 4.52 per cent respectively.

Commenting on the rate, economists at Financial Derivatives company said the rate increase was expected due to the renewed pressure on Niara, and the heightened food prices which are further exacerbated by seasonality.

They added that this may force the CBN to either raise interest rates by 50bps or 100 basis points increase, in line with most other Central Banks in the World.

The report read in part, “Nigeria announced its official inflation for April today as scheduled. As widely anticipated, headline inflation rose by 0.49% to 33.69%. The renewed pressure on Niara, and the heightened food prices which are further exacerbated by seasonality are the major stoking factors.

“The sustained uptick in the general price level was mainly due to a surge in the food basket, which increased by 0.52 per cent to 40.53 per cent. This is not surprising as the second quarter is typically the peak of the planting season. Some of the commodities that witnessed the highest spikes are millet flour, Garri, bread, yam and other tubers, vegetable oil, and fish. Core inflation moved in tandem with food inflation, increasing by 0.94 per cent to 26.84 per cent from 25.90 per cent. This implies that Nigeria’s inflation is more structural than transient.

“Two major uncertainties have impacted inflation expectations & psychology in the past few months. These include the price of diesel and Naira misalignment in the forex market. The price of diesel declined by 29.41 per cent to N1200/litre from N1700/litre while the exchange rate appreciated by 82 per cent. After the CBN policy implementation in February, there was a noticeable decline in the month-on-month inflation by 10bps in March and another 73bps in April. CBN is right on track with what needs to be done to rein in inflation. The MPC meets next week, and expectations are for either a 50bps or 100 basis points increase, in line with most other Central Banks in the World.”