The Central Bank of Nigeria (CBN) is making a big move to raise the stake in the remittance game, announcing a strategic move to double foreign currency inflows through official channels.

This ambitious plan involves granting Approval-in-Principle (AIP) to a wave of 14 new International Money Transfer Operators (IMTOs).

“This initiative is a win-win,” says CBN’s acting director of corporate communications, Hakama Sidi Ali. “By fostering greater competition and innovation among IMTOs, we’ll not only see a rise in the sustained supply of foreign exchange in the official market, but also potentially lower transaction costs and increased financial inclusion.”

This translates to a more liquid Nigerian Autonomous Foreign Exchange Market (NAFEX), according to Ali, ultimately leading to a “market-driven fair value for the naira.”

This strategy directly addresses a key challenge for Nigeria: the historical volatility of its exchange rate.

Remittances, a significant source of foreign exchange (over 6% of GDP!), have been susceptible to external factors like fluctuations in oil exports and foreign investment. By bolstering formal remittance flows, the CBN hopes to create a more stable financial landscape.

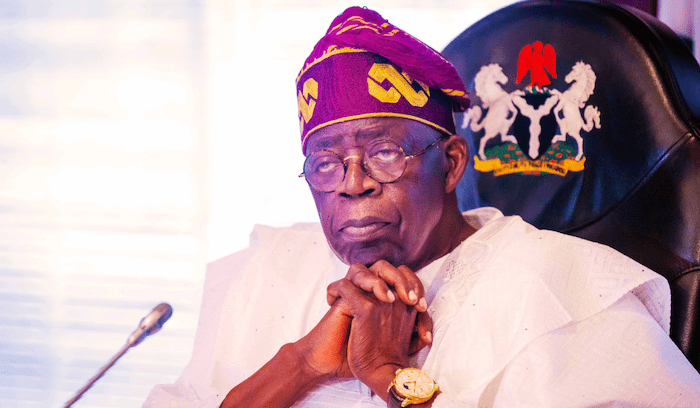

The influx of new IMTOs is just the first step in a multi-pronged approach. The CBN, under Governor Olayemi Cardoso’s leadership, has established a dedicated remittance task force.

This collaborative unit brings together industry specialists to work hand-in-hand with the private sector and market operators.

Their mission? To streamline the remittance ecosystem in Nigeria and make sending money home easier than ever.

Forged during discussions with IMTOs at the World Bank/IMF Spring Meetings this year, the task force reflects the CBN’s commitment to open communication and collaboration.

Regular meetings will ensure the strategy’s effective implementation and allow for adjustments based on the impact of these new measures.

Nigeria’s move to supercharge its remittance game is a strategic play with the potential to strengthen its financial footing and unlock significant economic growth.

With a clear plan and a focus on public-private cooperation, the CBN is poised to harness the power of remittances for a more prosperous future.

fFCZgTJeoRqK