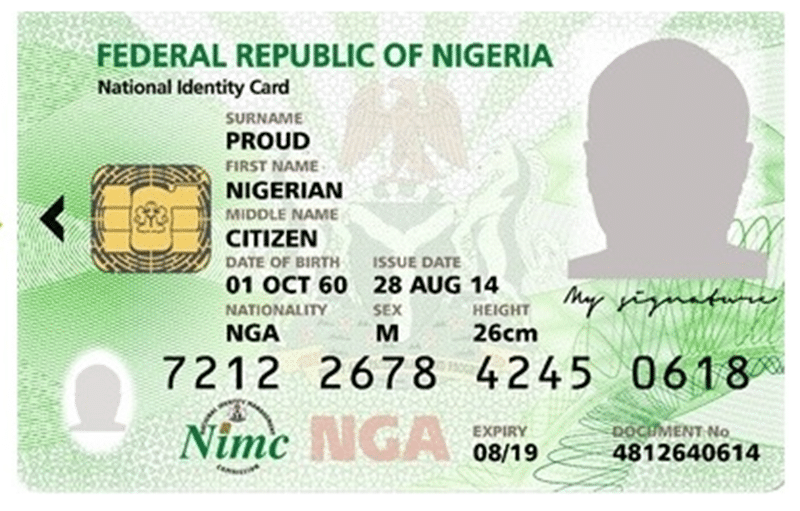

The Federal Government, in an ambitious move to revamp its national identity system, has announced plans to launch three innovative national identity cards for approximately 104 million citizens.

Scheduled for a May unveiling, the cards were being introduced by the National Identity Management Commission (NIMC) in collaboration with key financial and regulatory bodies.

Technical Adviser on Media and Communications to the NIMC Director-General, Ayodele Babalola, revealed that the launch of the bank-enabled National ID card, the social intervention card, and an optional ECOWAS National Biometric Identity Card was aimed at addressing various needs of the Nigerian populace.

However, the official launch date is pending Presidential approval.

The new IDs are a collaborative effort between NIMC, the Central Bank of Nigeria (CBN), and the Nigeria Inter-bank Settlement System (NIBSS), aiming to foster service delivery in a cost-effective and competitive manner.

Digital/virtual versions of all cards will also be available for those preferring digital formats, albeit with limited functionalities,” Babalola stated, emphasising the government’s drive towards digital inclusivity.

The initiative comes on the heels of the World Bank’s Country Director for Nigeria, Shubham Chaudhuri’s, announcement of collaboration with NIMC to roll out digital IDs to all Nigerians of working age by mid-2024.

This ambitious target aligns with the government’s vision of ensuring universal access to digital identification.

The planned IDs include a bank-enabled National ID designed to cater to the financial transactions of the middle and upper economic segments. The National Safety Net Card aims at facilitating secure access to government services and interventions, particularly targeting 25 million vulnerable Nigerians. The optional ECOWAS card will be issued in collaboration with the Nigerian Immigration Service, primarily for international identification within the ECOWAS region.

Each card boasts unique features aimed at enhancing the user experience. The bank-enabled ID will function as a debit and prepaid card, incorporating biometric authentication to facilitate identity verification even in areas with limited network coverage. The National Safety Net Card, apart from being an identity card, will serve as a medium for accessing various government social programs, with a validity of 10 years and compliance with the eNaira standards.

The announcement has drawn mixed reactions from experts. While some see it as a positive step towards digital inclusion and financial access, others argue it might be redundant given existing identification systems like the NIN and BVN. Concerns about data privacy, the technological infrastructure for such a vast rollout, and the prioritization of government resources were also highlighted.