The Central Bank of Nigeria has raised interest rates by 150 basis points to 26.25 per cent from 24.75 per cent in March to tackle rising inflation.

CBN Governor, Olayemi Cardoso disclosed this on Tuesday at the 295th Monetary Policy Committee press briefing in Abuja.

CBN had continued tightening of monetary instruments to bring down inflation.

The 295th MPC meeting is the third since the appointment of Cardoso in September last year.

The key focus of the MPC meeting was to achieve price stability by using tools available to rein in inflation,” Cardoso explained.

He identified food inflation as a key driver, attributing it to rising transportation costs, infrastructure challenges, insecurity, and exchange rate issues.

This announcement coincides with ongoing public struggles due to high commodity prices and a rising cost of living.

The removal of fuel subsidies last year and the floating of the naira have had a significant impact. Nigerians are facing historic high inflation, sparking protests and pressure from labour unions.

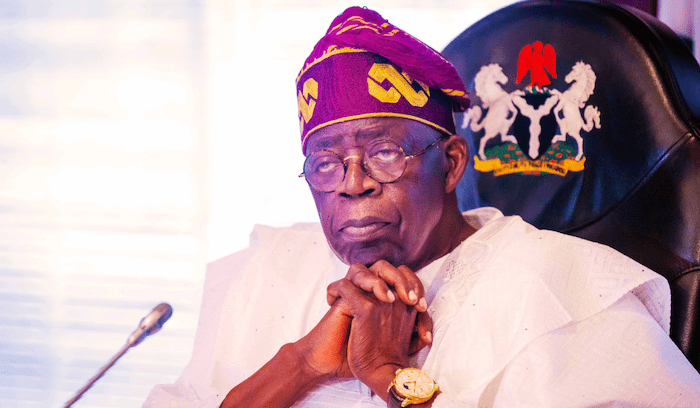

President Bola Tinubu has urged patience, expressing confidence that ongoing government reforms will eventually ease the burden.

While the CBN has taken steps to address the falling value of the naira, including targeting cryptocurrency exchange Binance, recent gains appear to be short-lived.

The aggressive interest rate hike signifies the CBN’s determination to combat inflation. However, its effectiveness remains to be seen.