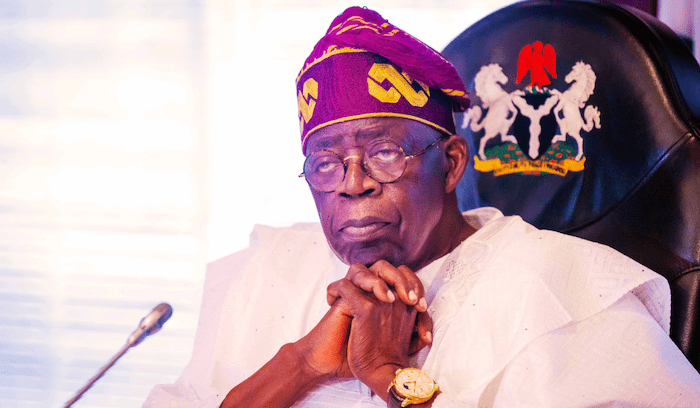

President Bola Ahmed Tinubu has directed the Nigerian Consumer Credit Corporation (CREDICORP) to facilitate the return of Peugeot Automobile and Dunlop Tyres to Nigeria as part of the country’s efforts to introduce credit facilities for purchasing new cars.

This move is part of Nigeria’s broader plan to become one of the nations offering consumer credit for the acquisition of brand-new vehicles.

Engr. Uzoma Nwagba, Managing Director/CEO of CREDICORP, confirmed the president’s directive during the launch and signing of a Memorandum of Understanding (MoU) for a N20 billion consumer credit fund aimed at helping Nigerians purchase locally assembled cars.

The event, which took place in Abuja, was a collaboration between CREDICORP, the National Automotive Manufacturers Association (NAMA), and the National Automotive Design and Development Council (NADDC).

Nwagba shared that he had presented a progress report to President Tinubu regarding the N20 billion fund, which is designed to assist Nigerians in buying locally produced cars. The president, he said, emphasized the importance of revitalizing the Nigerian automotive industry by bringing back major players like Peugeot and Dunlop, adding, “I want to see Peugeot, Dunlop, and others return to the country.”

The new initiative aims to create a credit system similar to those in more developed countries, where people can buy cars with single-digit interest rates. Nwagba also announced that the CREDICORP auto financing scheme will officially begin in January 2025.

As part of this initiative, CREDICORP plans to work closely with local automobile manufacturers and industry stakeholders, such as NADDC and NAMA, to lower vehicle prices and make them more affordable for Nigerians. Nwagba emphasized that the goal is to make financing more accessible and affordable, with a focus on bringing down interest rates for consumers.

“We are focused on making financing easier and more available. Our aim is to bring rates down over time, targeting single-digit interest rates, so Nigerians can afford to buy vehicles more easily,” he explained.

The initiative will also involve collaboration with financial institutions, which will assess applicants based on their creditworthiness. For those with strong credit histories, financial institutions will offer loans with favorable terms, backed by CREDICORP’s capital and guarantees.

Nwagba acknowledged the challenges posed by high interest rates, which have often been a barrier to accessing affordable credit in Nigeria. However, he expressed confidence that the new scheme would provide Nigerians with better access to credit for vehicle purchases and improve mobility within the country.