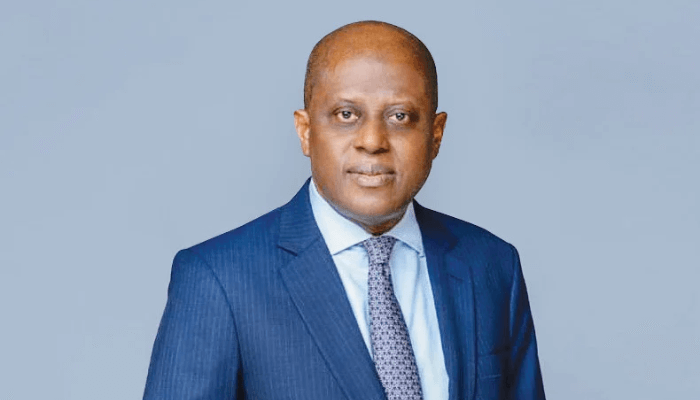

The Governor of the Central Bank of Nigeria, Mr Olayemi Cardoso, has announced that Nigeria’s foreign exchange reserves have reached over $40bn, marking their highest level in 33 months.

He disclosed a symposium in Abuja on Thursday, which coincided with the unveiling of the compendium, “Promoting Stability in an Era of Economic Reforms: The Journey So Far,” celebrating the first anniversary of the Bank’s management team.

In his keynote address, Cardoso reflected on the significant milestones achieved under his leadership, stating that the reforms initiated by the Bank had begun to yield positive results.

According to a press statement on Thursday, Cardoso described the past year as one of transformation despite the challenging economic environment.

The governor noted that inflation, which had surged to 24.1 percent by mid-2023, is now downward, signifying the effectiveness of the Bank’s interventions.

The statement read, “According to Governor Cardoso, the reforms had started to yield positive results, including marked improvements in the FX market and a stabilization of foreign reserves, which have now surpassed the $ 40 billion mark, the highest in 33 months.

“While noting that inflation remained elevated, he said it was on a downward trend, signaling that the reforms were taking hold in restoring market equilibrium and fostering growth.”

He attributed these achievements to robust policy measures, including recalibrating the Monetary Policy Rate, which was increased by 850 basis points to 27.25 percent, and raising the Cash Reserve Ratio for commercial banks to 50 percent.

He explained these measures aimed at curbing inflation and stabilizing the economy.

Cardoso also highlighted improvements in the foreign exchange market, citing the elimination of multiple exchange rate windows, which had previously created arbitrage opportunities and deterred foreign investment. He noted that this reform alone had addressed a backlog of FX settlements and curtailed revenue losses, estimated at N6.2tn in 2022.

The CBN’s drive to increase foreign remittances is another cornerstone of its economic strategy. Cardoso reiterated the Bank’s ambitious target of achieving $1bn in monthly remittances, which he described as critical to bolstering Nigeria’s foreign reserves and enhancing economic stability.

He also outlined steps taken to address Nigeria’s declining foreign direct investment and portfolio investments, which had posed challenges for over a decade.

To tackle these issues, the CBN implemented new operational guidelines for Bureau de Change operators, enhancing regulation and minimizing disruptions in the FX market.

Cardoso emphasized the CBN’s focus on digital transformation through its Digital-First Initiative.

This approach, he explained, has automated key processes, reduced operational costs, and introduced data-driven tools to enhance policy-making. The Bank has also launched an Integrated Data Collection and Sharing Portal and established an Investor Relations Unit to create a transparent, investment-friendly environment.

Cardoso further emphasized the importance of collaboration between fiscal and monetary authorities, which he described as essential for cohesive policymaking.

The statement also noted that Lagos State Governor Babajide Sanwo-Olu commended the CBN’s leadership for their commitment to transparency and constructive self-assessment.

Sanwo-Olu also stressed the need for unity in addressing Nigeria’s economic challenges.