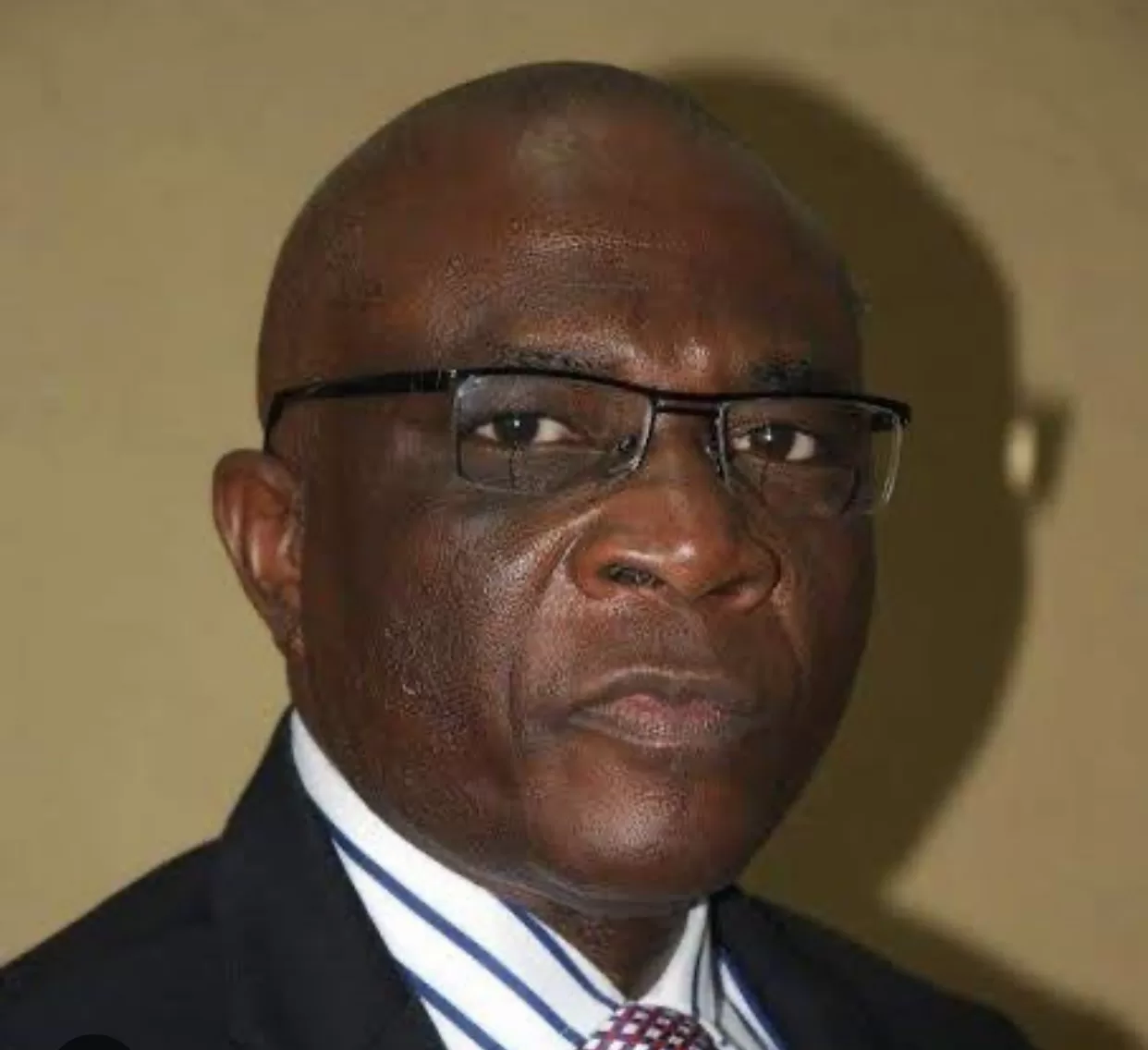

Bayo Onanuga, special adviser to the president on information and strategy, has assured Northern governors that the recently proposed tax laws will not increase the number of taxes.

Onanuga spoke on Thursday in a statement posted on social media, addressing the governors’ concerns over the proposed tax laws.

Presidency has said contrary to job loss fears and perceived marginalisation of the North, the tax reform bills currently before the national assembly will benefit all states and harmonise the country’s tax laws for greater efficiency.

It said it became necessary to address the misunderstandings and misgivings around the tax reform already embarked upon by the administration following a meeting of the Northern Governors last Monday.

The Special Adviser to the President on Information and Strategy, Bayo Onanuga, argued this in an explainer titled, ‘Explainer: Proposed tax reform bills not against the north; they will benefit all states’ on Thursday.

At a meeting on October 28, 2024, Governors of the 19 Northern States, under the platform of the Northern Governors’ Forum, rejected the new derivation-based model for Value-Added Tax distribution in the new tax reform bills before the National Assembly.

The meeting also had traditional regional rulers, led by the Sultan of Sokoto, His Eminence Muhammadu Sa’ad Abubakar III, in attendance.

A communiqué read by the Chairman of the forum, Governor Muhammed Yahaya of Gombe State, said the proposition negates the interest of the North and other sub-nationals.

President Bola Tinubu and the Federal Executive Council recently endorsed new policy initiatives to streamline Nigeria’s tax administration processes.

The Federal Government said the new laws are meant to enhance efficiency and eliminate redundancies across the nation’s tax operations.

The reforms emerged after a review of existing tax laws since August 2023. The National Assembly is considering four executive bills containing these tax reform efforts.