The Chief Executive Officer of Nigerian Education Loan Fund (NELFUND), Akintunde Sawyerr, stated this yesterday while unfolding the conditions would-be beneficiaries will be required to meet.

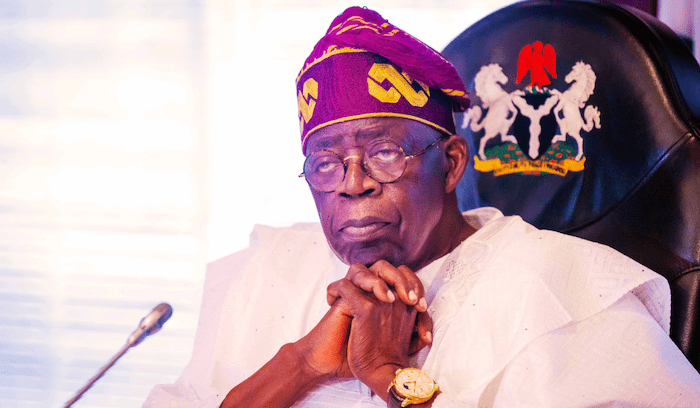

No fewer than 1.2 million students are expected to benefit from the cardinal programme of the Bola Ahmed Tinubu Administration.

President Tinubu on April 3 signed into law the bill on the scheme in line with his electoral promise that no Nigerian student would drop out of school on account of lack of funds.

ambitious cardinal programme will be funded with one per cent of the total annual collectable revenue by the Federal Inland Revenue Service (FIRS).

This year, the revenue target given to the FIRS is N19.4 trillion.

Repayment, according to the law, will commence two years after the completion of the National Youth Service Corps (NYSC) programme.

Speaking yesterday on other conditions for beneficiaries, Sawyerr said students in federal institutions such as universities, polytechnics, colleges of education and technical colleges, whose institutions have completed and uploaded their student data would get the opportunity.

He said: “We are going to start with federal institutions because it is a programme that we have to roll out in phases. It will eventually be rolled out to state-owned institutions.”

Sawyerr said no guarantor was needed for students to access the loan.

He said applicants would be required to provide their “Joint Admissions and Matriculation Board (JAMB) letter, National Identification Number (NIN), and Bank Verification Number (BVN).”

He added: “Applicants are also to complete the application, including personal details, academic information and details of financial need and submit the application after reviewing it.”

Speaking on the repayments, he said the loanees, whether they are working with the government or in the private sector, must pay back the loans after two years.

He explained: “The agency will pay 100 per cent of the fee for the loanees to the institution. There is also the track of providing stipends to the loanees.

“We only pay for one session at a time because people drop out of institutions. They change institutions or change their mind about the course they are doing.”

On the possibility of bad loans, he said the agency was trying to make sure that it had as much information about the applicants as possible and be sure that they were bonafide Nigerian citizens and were of good standing.

“We also have various ways of working with security agencies to ensure that the people who are applying for these loans are not people who may want to be fraudulent,” Sawyerr said.