Speaking in Lagos during a series of meetings with stakeholders in the education sector yesterday, Sawyerr said the fund was a tool for wealth redistribution in the society.

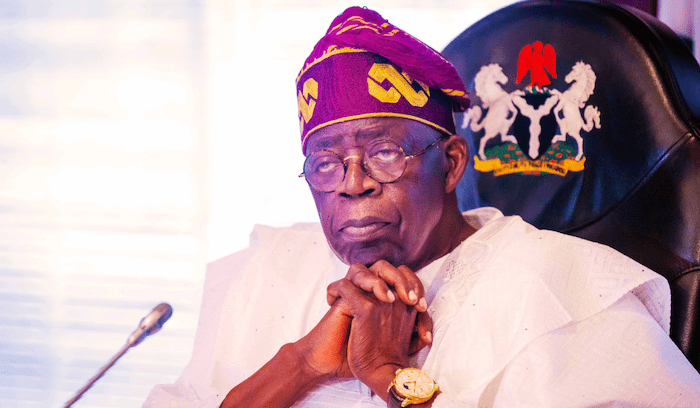

” Though President Bola Tinubu believes the fund is for all Nigerians, some factors have not made us to consider including students in private institutions as beneficiaries for now. We must understand that the scheme is a means to redistribute wealth to balance the society.

”We have to also know that it is a social programme meant to help in the education of the poor. It is a social scheme meant to help the people at the lower cadre.

“It is generally taken that if your child attends a private university, you may not be seen as being poor. That one apart, if the tuition fee in a private university is say N2 million, you can imagine how many students in a public university such an amount can take care of.

”Yes, parents of students in private schools also pay taxes, but we have to consider the impact of getting as many people as possible to have access to tertiary education,” he explained.

The money to fund the scheme is one percent of the revenue generated by the Federal Inland Revenue Service, FIRS, annually.

On how much a beneficiary could apply for, Sawyerr said it would depend on the course of study and the tuition to pay.

He said: “There is no benchmark for now or limit on how much to access. The tuition fees vary from one school to the other, as well as the fees paid for courses. But we have a list of all courses run by our schools and getting to know the tuition fees is not difficult. What can be accessed is divided into two parts. Tuition fee that we will be paid directly into accounts of schools and stipends that students may need for daily living and is paid into students’ accounts.

“The stipends also vary based on the location and the cost of living among others. On the repayment plan, it is a revolving loan and has no tenor. The reason is that beneficiaries are likely to get different types of jobs after graduation and the salaries can never be the same. So, the 10 percent that will be repaid monthly will be different too.’

” On how to deal with defaulters, the NELFUND boss said giving false information could lead a beneficiary to jail.

“We don’t want to criminalise anything, but a beneficiary may land in trouble for some reasons. For instance, repayment is expected to start two years after the completion of the National Youth Service Corps, NYSC, Scheme, a beneficiary can defer repayment if he has not secured a job.

”All he needs to do is to swear an affidavit to that effect and communicate same to us, but if after due diligence, he is found to have lied, then he becomes a criminal,” he said.

On how many beneficiaries are expected, he said at least 1.2 million students and others learning skills acquisition in government approved centres would be covered

He allayed fears that the scheme could be turned to a sort of national cake by some beneficiaries, saying there were checks to prevent default, even though it might not be possible to get everybody to repay.

“This is because some may take the loan and they even die before completing their studies or repay at all. However, such number would be negligible. The process of applying will be online and we are limiting human contact as much as possible.

”Within 30 days of applying, a beneficiary is expected to get his loan except there is any issue with the application, may be incomplete information or whatever,” he added.

However, he said anybody with criminal records or conviction would not benefit from the scheme.